Four Lessons I Learned About Money From the Real Housewives

There are two reasons why anyone watches The Real Housewives franchises: The money and the drama.

Any good Housewives fan has googled “housewife name + net worth” just to see how much you need to save up for a flight in a PJ (a private jet, in Bravo-speak). Once you look up the wealth of the cast members, it’s easy to see that there is a huge disparity in wealth among people generally thought of as “rich.”

So how does one get “rich” like a Real Housewife? Well, it might not involve actually being that rich. After examining the evidence gleaned from countless Housewives episodes, here’s what I learned about how to live a life of luxury and more importantly what not to do.

You never can tell anything about someone’s finances by looking at them!

Teresa Giudice and husband Joe Giudice, both of the “Real Housewives of New Jersey,” pleaded guilty in March 2014 to multiple federal fraud charges, including conspiracy to commit mail and wire fraud and lying on mortgage and loan applications. Teresa was freed from prison in December 2015 after serving 15 months; Joe began serving his 41- month sentence in June 2016.

In 2013, NeNe Leakes remarried her ex-husband Gregg Leakes, and the “Real Housewives of Atlanta” stars were accused by their wedding planner of not paying a balance of more than $1 million. Leakes denied the accusation on her Twitter account. The case was eventually dismissed.

The people on these shows need you to think they are fabulously wealthy. As a case study, let’s take a look at Dorit Kemsley, from Real Housewives of Beverly Hills and Jen Shah from Salt Lake City.

She literally has Chanel dripping from her ears. And yet, she and her husband, PK, are going through very public debt-related lawsuits. Allegedly they are at risk of going bankrupt, and listed their house for $8,000,000 to pay everything off (which may not even be enough).

Jen Shah of Real Housewives of Salt Lake and her “first assistant” Stuart Smith have been charged with conspiracy and money laundering by the U.S. Justice Department. They have allegedly been defrauding hundreds of senior victims in a telemarketing scheme that began in 2012 until 2021.

Housewives need to go on shopping sprees and buy fancy items to build their personal brand. No average person should try to keep up with them. All of this is for the show.

2. Only spend the money you actually have!

Imagine making $1.3 million for one season (like Phaedra Parks from RHOA), buying a $1.9 million house, and then getting dropped from the show the next year and being forced to sell the house for a loss. Income can change quickly, and you need an emergency fund to keep making mortgage payments in case you lose your job.

Just ask “She by Sheree” designer Sheree Whitfield who was fired twice from RHOA after building a “fashion line with no fashion” that was finally put out of it’s misery by Covid-19.

3. Everyone wants to own a business!

No one can ever deny that Kandi Burrus is a mogul and a boss but even her company, Mama Joyce LLC was dissolved by the state when an ex-employee sued her for not paying overtime wages back in 2016.

As we learned with franchise fav, Sonja Morgan, a failed business venture could mean losing all the money you invested (and if you don’t have the wealth of a Housewife that could mean all of your money). So don’t be tempted to start a line of toaster ovens if you have no experience in manufacturing small appliances, please.

4. There will always be someone richer than you!

It’s almost painful watching the extremely watchable women on RHOP try to one up each other while being the least wealthy franchise. The lesson here is to simply set realistic financial goals, don’t spend more than you need to and don’t base your own success on others.

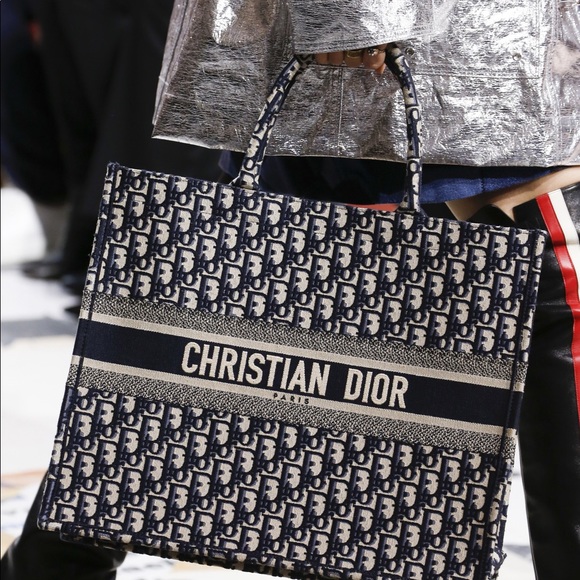

Too Fab Tote Available on Well Sleep Relax

Too Fab Tote Available on Well Sleep Relax